Designated Bond FFCB's regularly issued, liquid, noncallable securities that generally have a two (2) or three (3) year original maturity New issues of Designated Bonds are $1 billion or largerGovernment Agencies GNMA, FNMA, FHLMC, FFCB Municipals GO's and Revenue bonds Corporate Secured bonds, debentures, sub deben income bonds 13 What is a sinking fund?Pfm asset management llc account summary san bernardino county month ended january 31, 09 market % of ytm at ytm at security type market valuepar value

Santafenm Gov

Ffcb called bonds

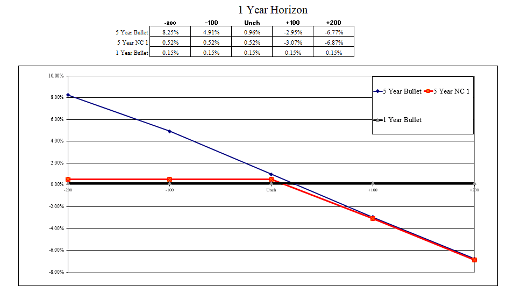

Ffcb called bonds-Duration will change For noncallable bonds 5yrs to maturity and under, these changes are small giving them convexity values near zero 3yr approx 010 5yr approx 03 A callable bond's duration will drop (shorten) as its price moves above par, this is called negative convexity 3yr nc 3mo1 sinking fund 2 call 3 refunding 4prerefunding sinking fund issuer deposits cash in an account with the trustee helps facilitate the retirement of its bonds calling bonds allows the issuer to redeem a bond issue before its maturity date either in hole or in part call premium

The Devil Went Down To Georgia Performance Trust

FFCB Abbreviation Federal Farm Credit Bank 1 variant Federal Farm Credit Bureau Final Fantasy Crystal Bearers First Federal Community Bank Foundation of Football Club Barcelona Fédération des Francophones de la ColombieBritannique Fédération Française des Commerçants en BestiauxThe decision to call a bond is based on the current level of interest rates and the outlook for interest rates When rates fall, issuers are likely to call the bond, pay off the debt, and issue a new bond at a lower interest rate Conversely, when rates rise, the call would likely not take place because the security priceCalled in 17 totaled $552B;

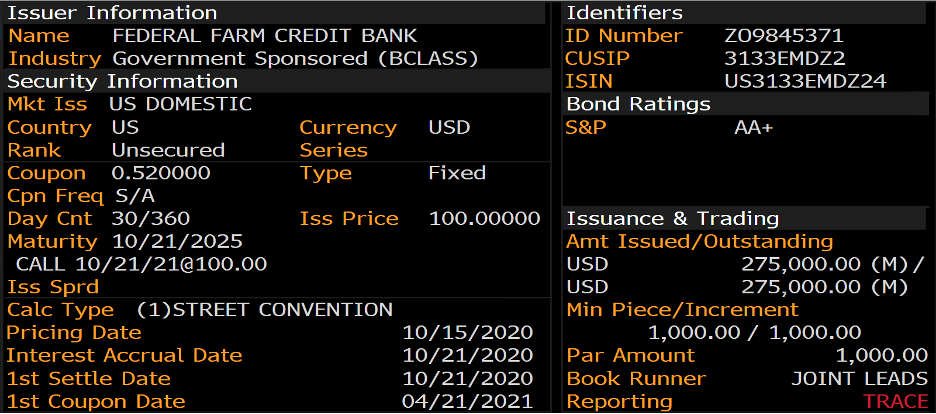

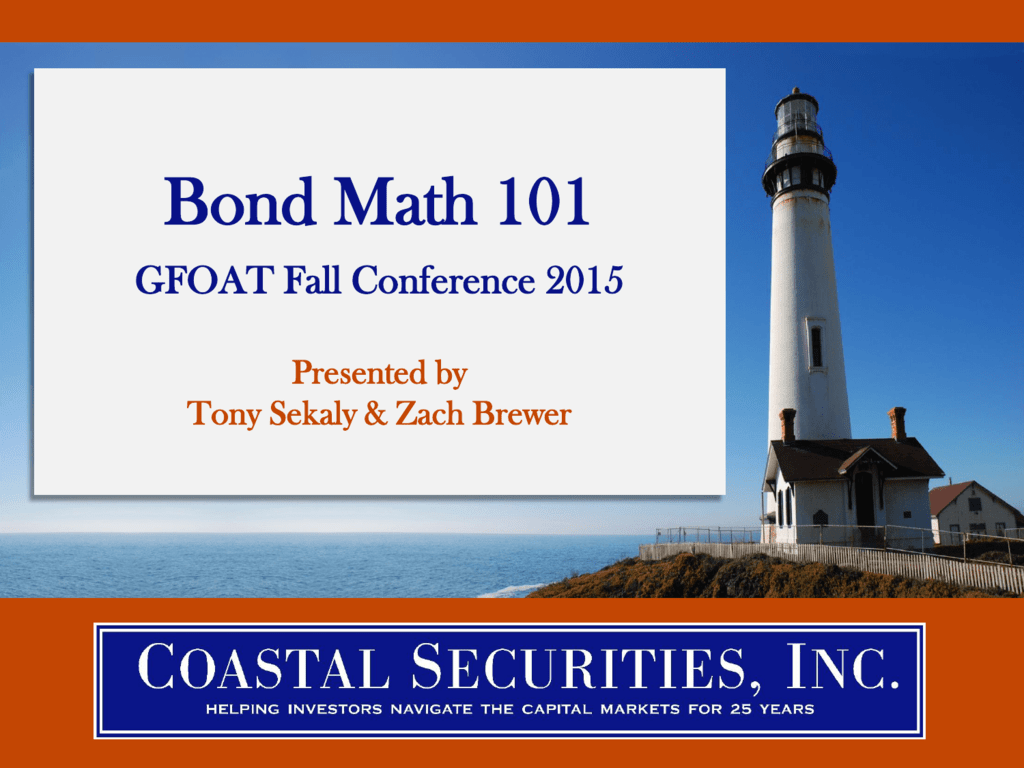

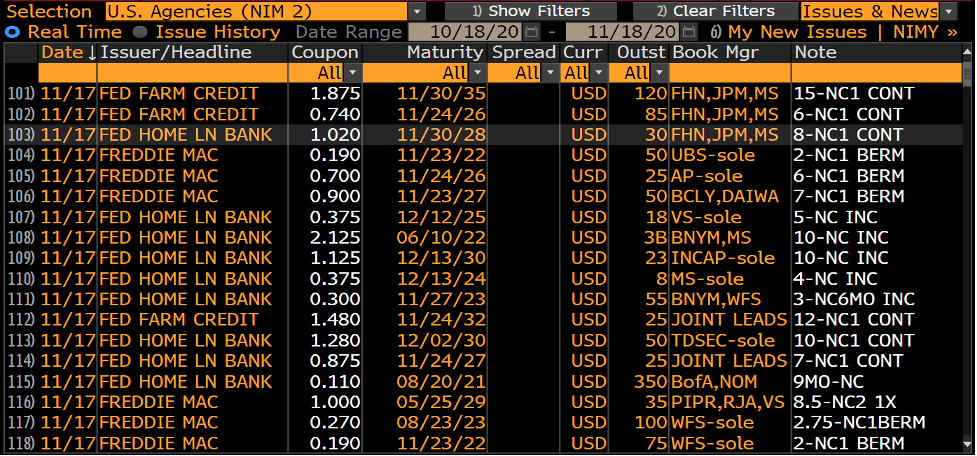

(FHLB), Federal Farm Credit Bank (FFCB), and Farmer Mac (FAMCA), US Treasury (UST) •Types include Callable bonds (fixed rate and stepups), Non callable bonds (or bullets), Discount notes 10 INV 221 Principles of Investing Accounting The Federal Farm Credit Banks Funding Corp (FFCB) said on Monday its plans to sell new fiveyear designated bonds through the Federal Farm Credit Banks Consolidated Systemwide Bond Program on TuesdayThe 1375 percent bonds will mature on and were priced at 996 to yield 1479 percent, or 31 basis points over comparable US Treasuries The joint lead managers on the sale were Bank of America Merrill Lynch, JP Morgan and UBS Stock Investing (Reporting by Caryn Trokie) FFCB sells $10 bln 3yr designated bonds

Building material and clothing stores by 23%, 03% and 02%, respectively Gains were found in the sales of automobiles of 02%, and online and mailorders jumped 23%, which was the largest increase in a year(FFCB) Notes, bonds, discount notes AA a AAA Treasuries Notes, bonds, TBills AA a • If Rates Go lower, Government calls bond so they can reissue at lower yields What Price is the Bond Called At?• Almost always called at a price of par ($) Step Rate Bonds • Coupon Rates Increase Periodically

How A Callable Bond Worked

2

6 537% 18 600% Analyzing the Risk/Return Tradeoff Return vs Number of Negative Quarters to 197% 230%Email Rick Customer Philosophy My philosophy is simple, the bank or financial institution you are dealing with is only as good as the person sitting across the desk from you, on the other end of the phone, or the other end of the keyboard, whichever the case may be How A Callable Bond Worked The Federal Farm Credit Banks (FFCB) bond I bought in February finally got called;

Treasurydirect Gov

Ice Tmc What S New Previous Enhancements

5 years was approximately 105 basis points, while AAA Taxable GO bonds snapped in by an average of 41 basis points over a 10 year horizon The Federal Agency portion of the portfolio hindered overall results as high coupon Agency bonds were called and price appreciation was limited by a reduction of call protection on remaining securitiesWhat is the formula for a call premium, give an example When an issuer calls a bond early, will usually give a premium Call price par = call premium 103 100 = 3 Although they carry a government guarantee (implicit or explicit), agency bonds trade at a yield premium (spread) above comparable Treasury bonds In the example above, the FFCB bond is offered at

Ncsr Tit 0112 Htm Generated By Sec Publisher For Sec Filing

Ice Tmc What S New Previous Enhancements

A group of banks are in early talks about forming a consortium to raise capital for bond insurer Financial Guaranty Insurance Co, the Wall Street JournalStart studying Series 7 Debt Securities (Bonds) Corp & Muni Learn vocabulary, terms, and more with flashcards, games, and other study toolsFor more info about federal agency/GSE bonds, see my previous post Agency Bonds for Higher Yield Over Treasury A callable bond means after a certain date, the bond issuer can redeem the bond early, before the bond's stated maturity date

Frost Family Of Funds

Nmsto Gov

Federal Farm Credit Bank (FFCB) is a GSE, thus carrying an implicit guarantee on its debt, while Private Export Funding Corp (PEFCO) bondsBSBAX Northern Short Bond Fund ownership in FFCB / FEDERAL FARM CREDIT BANK BONDS 09/22 184 Security FFCB / FEDERAL FARM CREDIT BANK BONDS 09/22 184 184%Farm Credit Fixed Rate Bonds are high credit quality debt instruments, issued regularly and may be callable or noncallable Fixed Rate Bonds offer a high degree of flexibility, as they are issued in various amounts, maturities and structures, to meet the varied needs of the Banks of the Farm Credit System and investors

2

Port Orange Org

When you fill out the form above, we provide you the resources to multiple state and government sites to see if you are eligible to be awarded any unclaimed assets/money that is o NEW YORK, April 15 (Reuters) The Federal Farm Credit Banks Funding Corp on Tuesday launched a $2 billion issue of threeyear bonds, with pricing expected later on Tuesday, said a market source Bonds Fixed Rate Bonds Floating Rate Bonds Retail Bonds Other * Total Callable NonCallable LIBOR SOFR Other Outstanding 12/31/18 $22,774 $0 $78,971 $71,099 $,216 $0 $26,400 $1 $119 $281,780 Gross Issuance 181,0 0 53,467 21,039 40,512 6,557 13,040 0 152 316,646 Maturities 1,256 0 8,693 13,965 42,232 0 11,675 25 98 265,944

The Devil Went Down To Georgia Performance Trust

Nmsto Gov

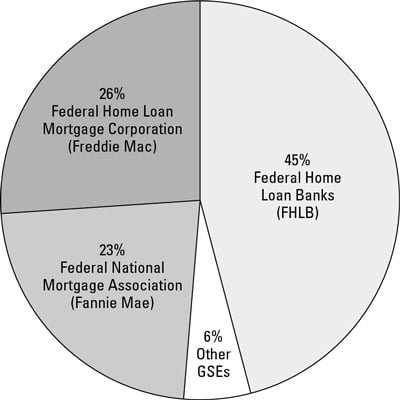

On any callable stepup bond depends greatly upon whether, and when, the issuer exercises the call feature In the first example, the investor will have received an average coupon of 400 percent if the CD is called in year two, 550 percent if it is called in year four and 660 percent if it remains outstanding until maturityA callable bond (redeemable bond) is a type of bond that provides the issuer of the bond with the right, but not the obligation, to redeem the bond before its maturity date The callable bond is a bond with an embedded call option These bonds generally comeAgency Bonds Agency bonds are issued by two types of entities—1) Government Sponsored Enterprises (GSEs), usually federallychartered but privatelyowned corporations;

2

Jefferies Company Inc Fhlb And Agency Strategies Gioa 09 March 26 09 Mike Effron Agency Trading Member Sipc J St Other Presentations Templates Templates Jefpoint Ppt Ppt Download

FFCB Short Interest FEDERAL FARM CREDIT BANK BONDS 09/22 184 Short Squeeze, Short Sale Volume, Borrow Rates, FailsToDeliver The model is developed along the lines of Merton's bond pricing formulation of implicit calls and puts on bond yield risk and default Findings Bottom line results show that the average bond yield for a 3M Farm Credit bond from January 13th 09 to February 10th 11 would be percent if the Farm Credit System had no GSE status, which isPfm asset management llc account summary san bernardino county month ended september 30, 08 market % of ytm at ytm at security type market valuepar value

2

Investment Concept Fundamentals California Debt And Investment Advisory

Bonds issued at high rates are today extremely highly likely to be called as a result of recent Fed rate cuts (and therefore you should never purchase a currently callable bond at greater than par value) For example, a callable issue by the Federal Home Loan Bank or the Federal Farm Credit Bank might offer over 500% over 10 years 10 Federal Land Banks (FLB) Bonds Currently issued through FFCB (Banks for Cooperatives and Federal Intermediate Credit Bank also issue through FFCB and have no direct issues outstanding) 11 Federal Housing Administration (FHA) Debentures Backed by the full faith and credit of the US Government 1212‐NC3MOCONT FFCB 219 33 6/1/33 $ 219 9/1/21 Anytime 57 bps vs 10yr 15‐NC6MOCONT FHLB 245 36 $ 245 Anytime 59 bps • Disadvantage is the potential extension if bond is not called and it goes to maturity Agency Cushions 29 Definition Callable Bonds that have below market coupon,

Facebook And Youtube Remove Trump Video

Tustin Granicus Com

Call Schedule This page lists all bonds eligible to be called in full or in part for the next five business days If a bond will not be called on its call date, the figure in the Amount Redeemed column will be 000 If there is an amount in this column, then the bond is being calledAnd 2) Federal Government agencies which may issue or guarantee these bonds—to finance activities related to public purposes, such as increasing home ownership or providing agricultural assistanceCallable bonds are more likely to be called when interest rates drop low enough that reissuance saves the issuer interest expense Holders of a called bond are faced with reinvesting funds in a lower interest rate market

Fn Capital Markets

Mobile Pastor Speaks On Gun Violence Among Teens Wpmi

Although they carry a government guarantee (implicit or explicit), agency bonds trade at a yield premium (spread) above comparable Treasury bonds In the example above, the FFCB bond is offered at a 23 basis point spread (476% – 453% = 023%) over the Treasury bond, and the PEFCO bond at just over a 22 basis point spreadThe Federal Farm Credit Banks Funding Corporation issues debt securities on behalf of the Banks of the Farm Credit System to support rural communities and US agricultureWhen are bonds called?

Treasury

Chapter Ten The Capital Markets Ppt Download

The Federal Farm Credit Banks (FFCB) bond I bought in February finally got called For more info about federal agency/GSE bonds, see my previous post Agency Bonds for Higher Yield Over Treasury A callable bond means after a certain date, the bond issuer can redeem the bond early, before the bond's stated maturity dateAgency bonds are issued by either a governmentsponsored enterprise (GSE) or a governmentowned corporation, and are debt obligations solely of the issuing agency GSEs include Federal Home Loan Bank (FHLB), Federal Farm Credit Bank (FFCB), Federal National Mortgage Association (FNMA), and Federal Home Loan Mortgage Corporation (FHLMC)View and compare BOND,CUSIP,NUMBER,LOOKUP on Yahoo Finance

Intermediate Fixed Income Course Learn Bonds Cfi

Over Investing In New Issue Agency Callable Bonds Sin 1

About Callable Bonds For many years, the FHLBanks have been wellknown issuers of callable bonds (also known as Optional Principal Redemption Bonds) The majority of FHLBank callables are "Bermudan" style, with multiple discrete call dates upon which the bond can be redeemed inThe interest income on agency bonds generally is subject to federal and state taxes Interest on certain agency bonds, including securities issued by the FHLB and FFCB, is exempt from state taxes Agency bonds, when bought at a discount, may subject investors to capital gains taxes when they are sold or redeemedA foreign currency convertible bond (FCCB) is a type of convertible bond issued in a currency different than the issuer's domestic currency In other words, the money being raised by

Ice Tmc What S New Previous Enhancements

The Handbook Of Financial Instruments Manualzz

This compares to $517B in June 16 Through March, the cumulative par value called totaled just $11B Source Bloomberg and Stifel ‐ 10,000 ,000 30,000 40,000 50,000 60,000 70,000 Jan‐15 Jul‐15 Jan‐16 Jul‐16 Jan‐17 Jul‐17 Jan‐18 Monthly Redemptions (mm)1902 W Main St Clarksville , TX Red River County (903)Bonds are called bonds for a reason, and a bond of mother is the best bond in the world #HappyMothersDay21

Jefferies Company Inc Fhlb And Agency Strategies Gioa 09 March 26 09 Mike Effron Agency Trading Member Sipc J St Other Presentations Templates Templates Jefpoint Ppt Ppt Download

Resources Riskval Financial Solutions New York

Bond Math 101 Gfoat Fall Conference

Ecommons Cornell Edu

Ice Tmc What S New Previous Enhancements

2

2

Emerald Com

2

Gioa Us

2

Bankprospect Com

The Effects Of Government Sponsored Enterprise Gse Status On The Pricing Of Bonds Issued By The Federal Farm Credit Banks Funding Corporation Ffcb Emerald Insight

Redwoodcity Org

2

Platinum Bond Reporting

Www1 Nyc Gov

2

Official Statement Series 12a Revenue Bonds Manualzz

2

Facebook Exec I Don T Believe It Is A Primary Contributor To Political Polarization Fa News

2

2

The Effects Of Government Sponsored Enterprise Gse Status On The Pricing Of Bonds Issued By The Federal Farm Credit Banks Funding Corporation Ffcb Emerald Insight

Santafenm Gov

Chapter Ten The Capital Markets Ppt Download

2

Platinum Bond Reporting

2

Yakimawa Gov

The Devil Went Down To Georgia Performance Trust

2

Sanjoseca Gov

Mcohio Org

:max_bytes(150000):strip_icc()/bond-market1-5d51ac2dfdc443f29faf6274bcbf3300.jpg)

Foreign Currency Convertible Bond Fccb

Chapter Ten The Capital Markets Ppt Download

2

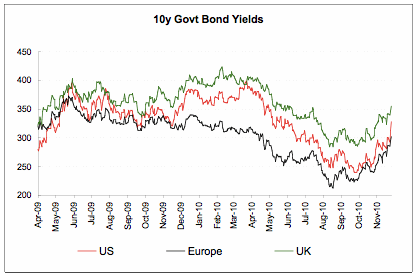

Unintended Consequences Of Monetary Policy Seeking Alpha

2

Ci Benicia Ca Us

Platinum Bond Reporting

Countytreasurer Org

2

2

2

Vega Trap Performance Trust

Bond Terminologies Pdf Bonds Finance Fixed Income

Nmsto Gov

Yakimawa Gov

Tustin Granicus Com

Investment Concept Fundamentals California Debt And Investment Advisory

Jefferies Company Inc Fhlb And Agency Strategies Gioa 09 March 26 09 Mike Effron Agency Trading Member Sipc J St Other Presentations Templates Templates Jefpoint Ppt Ppt Download

Agency Update April 12 21 Treasury Yields Declined Last Week Despite The Upbeat Economic Data As The Fed Continues To Convey Patience On Adjusting Their Highly Accommodative Monetary Policy The 10 Year Yield Declined By 6 Basis Points On The Week

2

2

Naplesgov Com

Bond Terminologies Pdf Bonds Finance Fixed Income

Ice Tmc What S New Previous Enhancements

2

Bonds The Other Market By George L Fulton Paperback Barnes Noble

/AgencyBonds_LimitedRiskAndHigherReturn32-9a575588ab6b4e4484cc80d0a8f9710c.png)

Agency Bonds Limited Risk And Higher Return

Investment Concept Fundamentals California Debt And Investment Advisory

Santafenm Gov

Ice Tmc What S New Previous Enhancements

2

Investment Concept Fundamentals California Debt And Investment Advisory

2

Bannockburn Org

485bpos 1 N1a1219 Htm Starboard Investment Trust Roumell Opportunistic Fund As

2

What Are Agency Bonds All About Dummies

Platinum Bond Reporting

Mobile Pastor Speaks On Gun Violence Among Teens Wpmi

2

Countytreasurer Org

0 件のコメント:

コメントを投稿